Intestacy Rules

When a person dies without leaving a valid Will, their estate is distributed in accordance with the Intestacy Rules. These Rules can sometimes leave those who believe they should have inherited without any provision from the Estate.

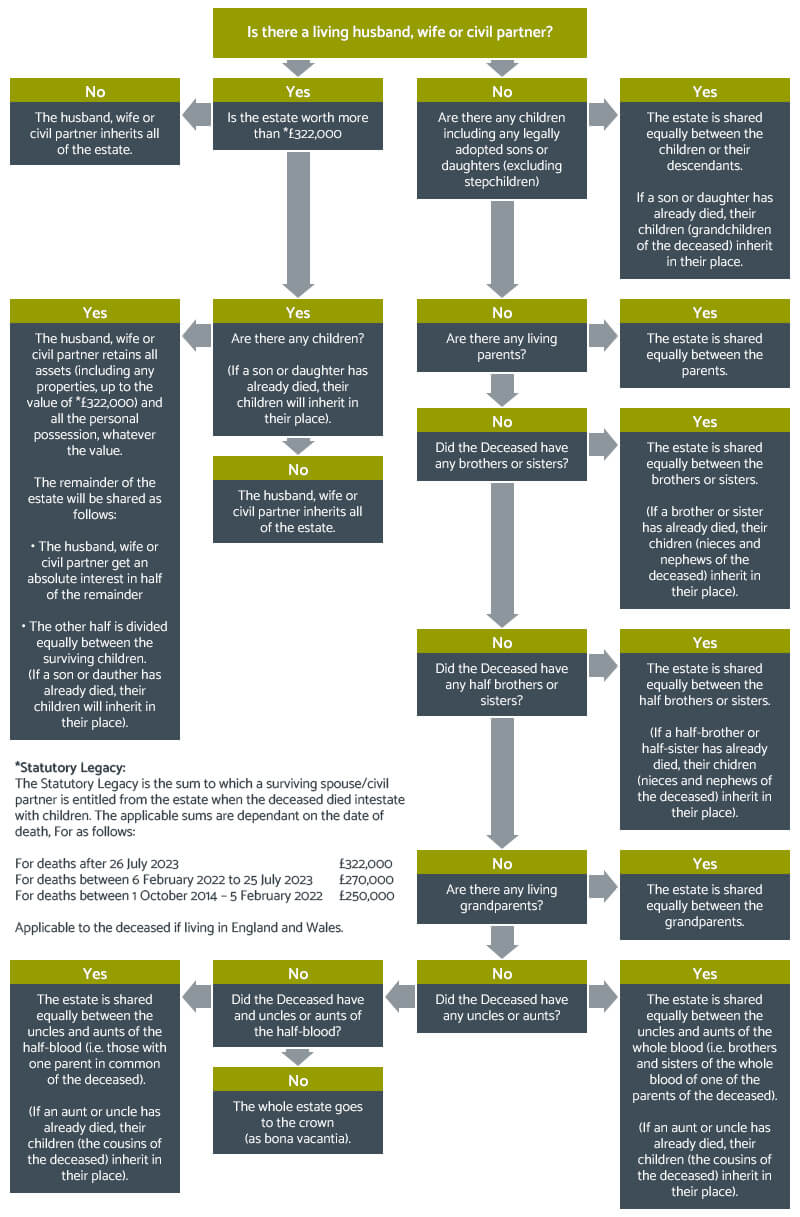

Who inherits the Deceased’s estate can depends on the marital status, whether there are any children and the surviving members of the immediate family. This Intestacy Rules flowchart below provides details of what happens step by step when the Deceased lived in England and Wales.

Inheritance Act

If the Intestacy Rules fail to make provision for you from the Deceased’s estate you may still be eligible to bring a claim under the Inheritance (Provision for Family and Dependants) Act 1975 (see Inheritance Act).

Our proven track record and expertise in dealing with Inheritance disputes & Intestacy entitlement help to guide our clients to successful outcomes with compassion and understanding.

We Can Help You.

Contact us and speak to specialist Inheritance and Will Disputes Solicitors today on 0161 785 3500 for a Free Initial Consultation to assess your case and discuss the next steps with you. We will consider all funding options including if we can handle your claim on a No Win, No Fee basis.

Inheritance (Provision for Family and Dependants) Act 1975

When the Intestacy Rules fail to make provision for you from the Deceased’s estate, it may still be possible to bring a claim under the Inheritance (Provision for Family and Dependants) Act 1975 (see Inheritance Act).

Our proven track record and expertise in dealing with Inheritance disputes & Intestacy entitlement help to guide our clients to successful outcomes with compassion and understanding.

As family relationships are varied and complex this flowchart is not definitive legal advice. If you have further questions, call our specialist Inheritance and Will Disputes Solicitors today on 0161 785 3500 for an informal conversation and Free Initial Consultation to assess your case and discuss the next steps with you. We will consider all funding options including if we can handle your claim on a No Win, No Fee basis.