Fines for employers failing to conduct right to work checks

Employers and business owners need to make sure they conduct the correct UK right to work checks for all employees or risk increased fines.

UK right to work fines

The Home Office announced that fines will increase in 2024 for business owners who flout the law, and employers could face a hefty £60,000 penalty.

From the start of 2024, the civil penalty for employing illegal workers will triple to £45,000 per worker for first offences and £60,000 per worker for repeat offences.

“Fines of this level are massive for most SMEs but can be mitigated with the right planning. Here we see just how seriously the Home Office takes illegal working in the UK, and this is a huge increase from £15,000 per worker for a first offence and £20,000 per worker for repeat offences.” says Partner and Employment Law Solicitor Susan Mayall.

“No matter what role when taking on any workers, employers need to be mindful of the need to carry out the relevant checks to ensure that the person is entitled to work in the UK,” she adds.

It is not only businesses that could be hit with the new fines; landlords permitting illegal migrants to rent their properties are also facing increased fines of up to £20,000.

Civil penalties for illegal employment

The Home Office issues fines once they have discovered that a business is employing a person who does not have permission to work in the UK and, as well as a hefty civil penalty; it is also worth noting that it is a criminal offence with unlimited fines and potentially a five-year prison sentence.

A staff member who works illegally also commits a criminal offence. This can lead to all wages being confiscated as proceeds of crime, a fine and up to 6 months imprisonment.

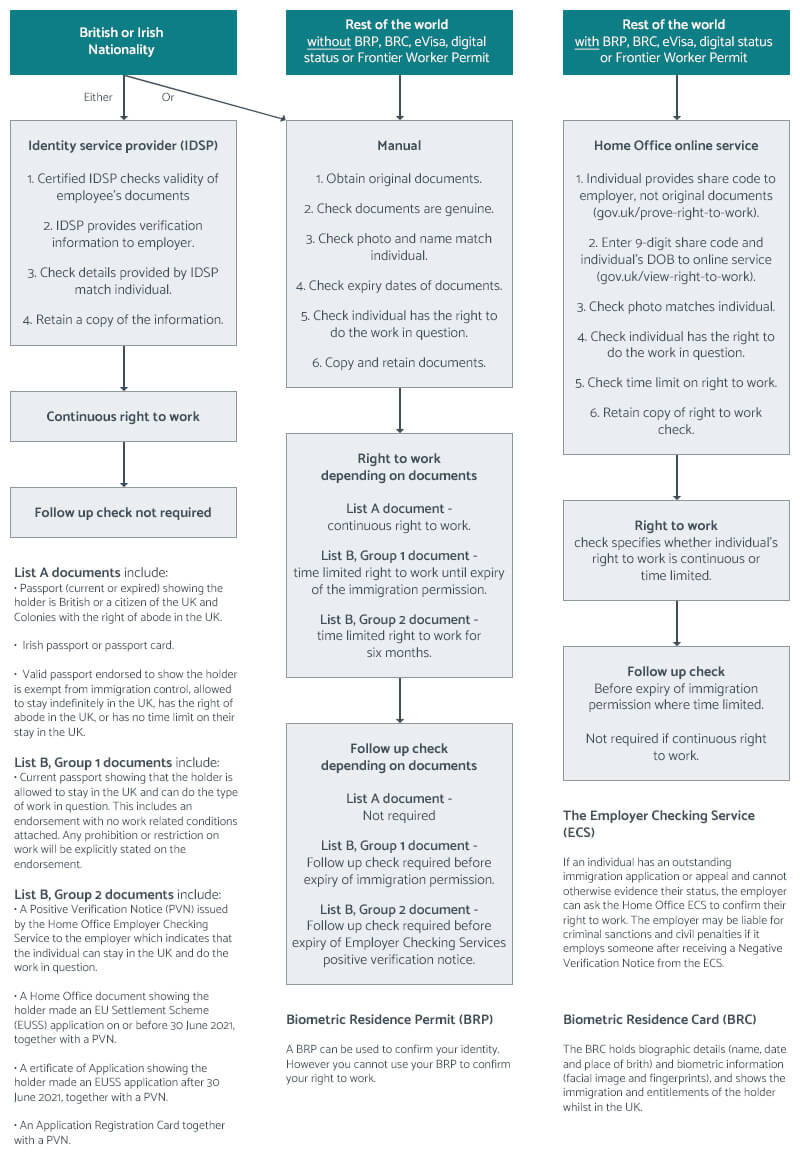

How to conduct a UK right to work check

- An employer is able to obtain a statutory excuse against liability for an illegal working civil penalty by carrying out right to work checks in line with Home Office guidance.

- Employers need to review and potentially improve their checking processes on who can and cannot work for them to mitigate and minimise their risk.

- It’s always advisable to carry out internal checks from time to time on staff.

- It's essential to make sure HR, hiring managers or the employee responsible for conducting right to work checks know the requirements involved.

- Employers must take immediate action if they suspect an employee is working illegally.

Immigration, Asylum and Nationality Act 2006

“Under the Immigration, Asylum and Nationality Act 2006 right to work checks are only required to be carried out when a person is employed under an employment contract,” adds Susan Mayall.

“However, the difference between an employee, worker, self-employed person and contractor is not always clear. Changes in the tax regime, under IR35 and case law on worker status, have highlighted the difficulties in being clear as to which category a person carrying out work or services fits into.”

“As such and to be on the safe side,I would recommend that right to work checks are carried out for all people providing services for your business.”

How can we help?

Employment law advice is sometimes necessary and, at Pearson Solicitors, we work closely with our employer clients and their HR teams to make sure the changing employment laws are covered.

For legal advice on all areas of employment law and advice on employment contracts contact our employment law solicitors on 0161 785 3500 or email enquiries@pearsonlegal.co.uk

Subscribe to our newsletterPlease note that the information and opinions contained in this article are not intended to be comprehensive, nor to provide legal advice. No responsibility for its accuracy or correctness is assumed by Pearson Solicitors and Financial Advisers Ltd or any of its members or employees. Professional legal advice should be obtained before taking, or refraining from taking, any action as a result of this article.